Are you writing for fun or profit, is it a business or is it a hobby? Without evidence of published works and records of profits and losses, it is a hobby, so says the IRS. Why even ask the question? Why does it matter? All too often, in my experience anyway, we women deny the importance […]

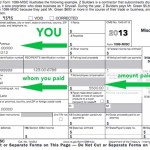

Tax Tips for Authors: When and How to fill out the 1099

As a self-publishing author, you should consider your writing as a business. And in this way, there are protocols that you need to follow — namely taxes. (See Tax Tips for Authors: Are you a Business or a Hobby? ) When Form 1099-MISC must be filed The basic rule is if you promote your writing […]

Tax Tips for Authors: Filling out the Schedule C for Artists, Writers and Performers

Tax tips for writers and artists. The tax deadline is just around the corner, but don’t panic! Now is a good time to review your record-keeping, for good or ill.

Tax Tips for Authors: Are you a Business or a Hobby?

United States tax time is here. As a writer you are classified as self-employed. To take advantage of your deductions, here are a few tips to help you this year and in the future.